Wyrmspan by Stonemaier Games has gone up for pre-order for both retailers and hobbyists. How do I go about figuring out how many copies to buy? This one is a bit of a head scratcher, but let's get started.

Wyrmspan is a Wingspan spinoff. My peers have described it as a love child between Flamecraft and Wingspan, two of our hottest games ever. The love child part was mine, but you get the idea.

The first step is to determine if I want any. Visiting the House of Horrors, also known as Board Game Geek, I see a couple things:

1. An overall low score. Looking at individual reviews, there seems to be a concerted effort to tank this game. I am told this is typical of BGG for unreleased games. So many experts on something that doesn't exist! Maybe it's too simple, too similar, or the fantasy theme rubs the high brows the wrong way. This is curious, but a low overall score will likely mean many customers will pan this game. If this were an unknown game, from an unknown designer, as a buyer, I would pan Wyrmspan. Another note: If enough people see this and pan the game, and it takes off as expected, there will be a shortage.

2. Very good reviews. A watched two reviews in a row that ranked Wingspan as a 7.5 out of 10 and Wyrmspan as an 8. The overwhelming consensus is the game mechanics are improved upon in Wyrmspan. I won't get into the details, because I honestly don't care about the details, but this is generally a good sign. So we have a concerted effort to tank this game by the BGG nerds and very strong reviews by the reviewers. This does make Wyrmspan slightly less than a sure thing, which was probably the intention of the bad peanut gallery reviews.

The second step is to look at past performance. As anyone in the stock market can tell you, past performance is an excellent gauge of future results. Err. Something like that. Let's ignore the love child aspect for a moment, ignoring Flamecraft (50 copies sold in the last year without a significant outage, I guess we're not ignoring it!) and look squarely at Wingspan's past performance.

Here I have a big problem, in that Wingspan was a COVID baby. I was selling it swimmingly for a couple months when it went out of stock and disappeared for six months. I admit I under ordered it a bit. This extended outage occurred right before we shut down. When we finally restocked, the game soared. Past performance on Wingspan is a bit of a mystery, so future performance of Wyrmspan is a bit unknown. This is an example of how in the dark you can be, if you didn't order the first thing properly. It's also a warning to learn how to properly parse your data. Under ordered plus COVID, means you don't know as much as you think you do.

Despite all this, I can crunch numbers and generally take Wild Ass Guesses. Now that I have a general feel for the likely sales numbers, the next step is budget.

How Much Can I Afford? Part of that question is how much can I afford right now, because a pre order with Stonemaier is a credit card charge for the full amount upon placing the pre order. If I order at a lower margin from GTS, I can pay for it on my terms, with the bill due a month after its release. The normal method for a game that's unlikely to go out of stock is to order the quantity I think I'll sell in that 30 day terms period. Wyrmspan is not normal and a 30 day supply will not be enough, as we think we know from Wingspan.

If I'm sitting on a pot of gold from the holidays, which I am not, I might risk up to a years supply of this game, considering how Wingspan disappeared for six months after release. At this stage I would like a six month supply of Wyrmspan, but I don't know what that is, because of Wingspan performance, and I can't afford it, regardless of how well it does. Instead I figure on something approaching a three month supply, which is really not enough, but it's what I can afford, even if this game tanks. This is an example of where having a strong cash reserve results in opportunities.

What can tank a game? So many things. Stonemaier might make everyone an offer they can't refuse next week. We compete with our partners and this kind of pump and dump betrayal is common. Do I trust Stonemaier not to do that? Today, yes. The components might be defective or low quality. It might be dumped online by low margin sellers. The boardgamegeek wankers who low ball the reviews, might turn out to have been right.

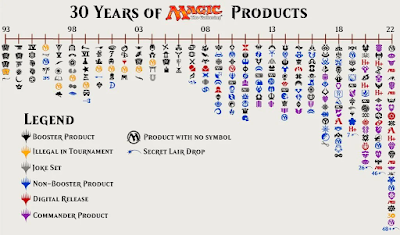

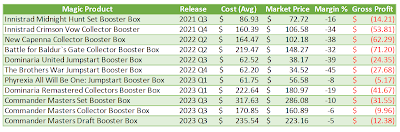

Basically, see Magic the Gathering on how a product can be screwed up by the publisher on a near quarterly basis. Also see Magic the Gathering on how everyone having a cash reserve and betting on the sure thing can screw up supply and demand and tank a game. Here we have to look at Stonemaier's past performance and how much you trust them to get it right. My trust level is moderate.

Triangulation and a Final Count. I set this game up in my online store for my customers, matching Stonemaier pricing. I announced it and... nobody has pre ordered yet. Maybe they will, maybe they won't. I have increased my Heat expansion pre order four times now, as my customers got on board. They were burned by the Heat outage, so they get that. It might be that my regulars, who are probably not the target for this game, send me the message that Wyrmspan is not for them. Maybe they'll all order direct.

My semi final numbers: 12 from Stonemaier with a few accessories. 36 from GTS. If Stonemaier didn't charge for everything in advance, I would order just from them.

I have sold 240 copies of Wingspan since late 2019. Let's hope past performance is an indicator of future results.

.jpeg)